Solutions for your clients, and your bottom line.

Benefit Solutions

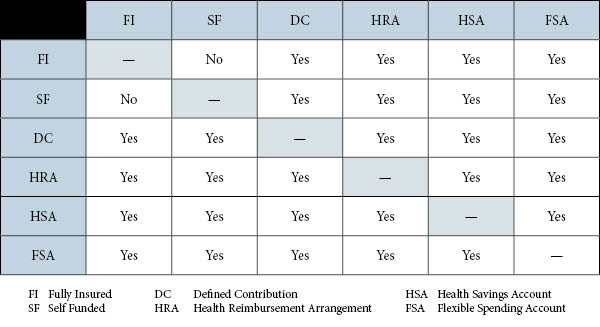

The results of a group’s Health Assessment will provide the information required to develop several Benefit Solution options. Below is a matrix of plans and funding options that will be used in these options.

Fully-Insured

- Health Maintenance Organizations (HMOs) emphasize preventive care and require participants to select a primary care physician from the list provided by the HMO. That physician coordinates all of the member’s medical care and refers them to specialists, when needed. Members who go outside the HMO plan for medical care (without prior approval) will pay all or most of the cost of that care from their own pocket.

- Preferred Provider Option (PPO) Plans – encourages participants to utilize in-network providers by offering them a higher level of benefits.

- Point of Service (POS) Plans – requires participants to select an in-network personal care physician. Like PPOs, in-network care is covered at higher benefit levels than out-of-network care.

- Exclusive Provider Options (EPO) Plans – similar to POS plans, EPOs offer lower out-of-network benefits.

- Small Group Self-Funding

- Defined Contribution Plans

- What is an HRA?

- What is an HSA?

- What is an FSA?

- Wellness (coming soon)

- Medical Travel (coming soon)